Deep Dive 50% plus moves

Objective: to learn from 50% moves in 40 days or less. Document the learnings to find similar stocks next year.

50% bullish Scan

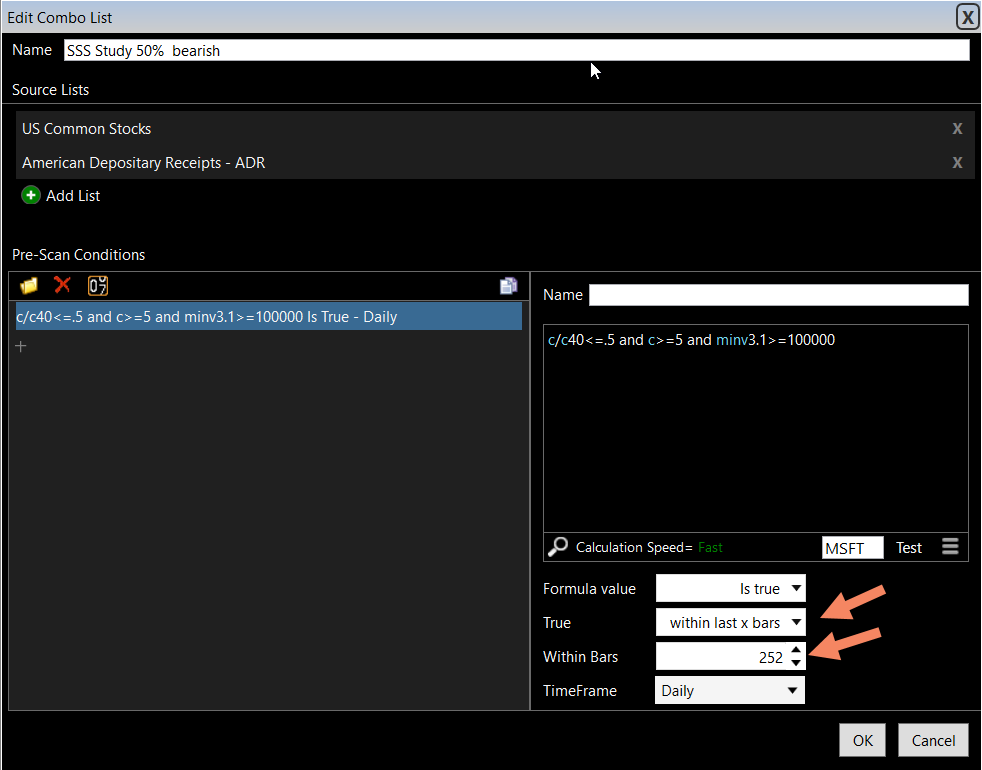

50% bearish Scan

Chart Template to show 50% move period

https://www.tc2000.com/~9HCNKc

What drives 50% plus moves bullish and bearish

What happens at the start of 50% moves

What was the price/volume action pre-50 % moves

What catalyst triggers 50% moves

Which sectors dominate 50% moves

What was the starting capitalization

What was the start price

What was the volume on the first b/o days

How did the move progress

Did the move start with a gap

How long the move lasts

How many legs

What happens after the move

How can you scan for it

What will be the stop on the first day

What stops subsequently?

The Deeper you go, the better it is

Join us on the Stockbee member's site as we do this year-end Deep Dive to learn from explosive moves

Break down each element of that setup

Break down each element of that setup What if I only trade low-priced stocks

What if I only trade low-priced stocks